SOC Hyperautomation for Financial Institutions

Torq delivers secure, scalable, AI-driven SOC automation at machine speed, empowering banks and financial institutions to stop fraud attempts, streamline compliance, and accelerate critical SecOps workflows.

10X

Faster response times

30%

Time savings across SecOps

95%

Tier-1 cases auto-remediated

Why Financial Institutions Choose Torq

Built for Banks

Torq HyperSOC™ effectively handles the unique speed, scale, and compliance demands of financial services. Torq provides secure, no-code/low-code and AI-built automations across phishing mitigation, fraud lockdowns, ransomware containment, IAM hygiene, and more — without the overhead.

Compliance-Driven

from the Core

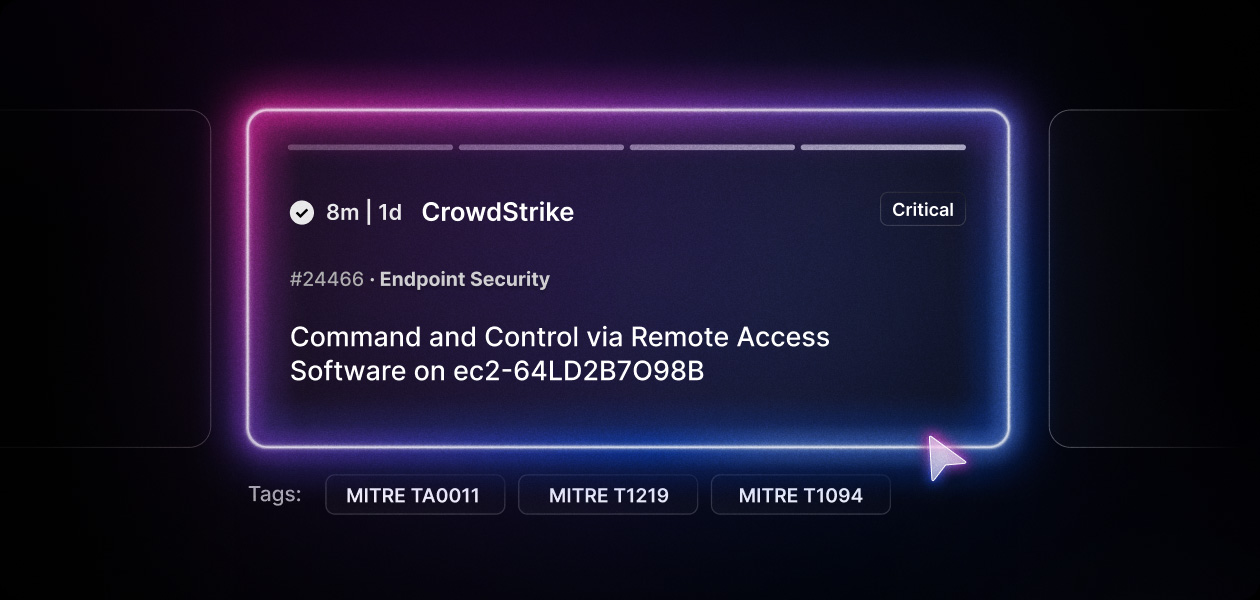

Whether it’s SEC, NIST, MITRE, PCI DSS, or GLBA, Torq delivers SLA-aligned, audit-ready automation that satisfies the strictest regulations and frameworks. Built on zero-trust architecture and engineered for secure on-prem and cloud interoperability, Torq makes it easy to prove what happened, when, and why — without slowing your team down.

Connect Everything.

Integrate Anything.

Torq connects with everything: ServiceNow, Microsoft, CrowdStrike, Abnormal AI, Wiz, Splunk, and beyond. Torq’s single-code-stack platform eliminates silos, speeds up integration, and maximizes the value of your existing security investments.

An AI Platform

That Delivers

With Torq Socrates and specialized AI agents autonomously managing alert triage, investigation, and remediation, Torq enables financial institutions to centralize oversight and securely scale automation across decentralized SOC operations.

Automate Your Most Critical Workflows

Fraud & Risk Management

Stop fraud faster than it starts. Whether it’s Zelle fraud, wire transfer abuse, or suspicious account activity, with Torq, you can lock compromised accounts in seconds, enrich alerts with full context, and notify customer support automatically — all before the next transaction hits.

Phishing Detection

& Containment

Phishing is the top threat to financial institutions — and one of the most time-consuming to investigate. Torq automates the entire phishing lifecycle, from inbox monitoring and threat intelligence enrichment to triage, case creation, and rapid remediation.

Ransomware & Malware Defense

Today’s threats move at machine speed — attackers are using AI to break out, move laterally, and deploy ransomware in minutes. Torq fights fire with fire, using agentic AI to triage, investigate, and remediate threats autonomously before humans even log in.

Identity & Access Management

Automate the entire IAM lifecycle — from just-in-time access approvals to periodic cleanup of inactive accounts. Torq enables secure, compliant user provisioning, self-service access validation, and instant response to suspicious behavior.

Compliance

& Audits

Torq builds audit-ready logs into every workflow, so you can prove exactly what happened, when, and why. Whether it’s PCI DSS, GLBA, FFIEC, or internal controls, you’ll have automated evidence for every action.

AI-Driven Case Management

Every alert counts — but not every alert deserves your time. Torq’s intelligent case management system automatically prioritizes alerts, enriches them with context, and routes them through triage workflows, resulting in faster responses and less noise.

How a Major Bank Transformed Its SOC in 90 Days

Facing analyst shortages and escalating threats, a top 30 U.S. bank leveraged Torq to quickly launch 100+ automated workflows — rapidly reinstating Zelle services after an SEC suspension, reducing fraud, and cutting investigation times from hours to minutes.

Key Outcomes:

- Over 100 workflows automated in 90 days

- Mean Time to Investigate (MTTI) reduced dramatically

- Zelle fraud detection and lockdown automated

- Automation scaled across IT, fraud, and GRC teams

- Improved response efficiency despite analyst shortage

More SOC Automation Resources for Financial Institutions

Ready to Automate Your Financial Defense?

Schedule your demo and see how Torq can enhance fraud detection, streamline compliance, and free your SOC team to focus on strategic tasks.